The financial markets are filled with various tools and indicators that traders leverage to make informed decisions. Amongst these, the Keltner Channel Indicator Pocket Option индикатор Keltner Channel has gained popularity due to its effectiveness in identifying trends and potential price reversals. In this article, we will dive deep into understanding how the Keltner Channel works and how you can utilize it on the Pocket Option platform for optimized trading strategies.

What is the Keltner Channel Indicator?

The Keltner Channel is a volatility-based envelope indicator that is used to define overbought and oversold conditions in the market. It consists of three lines: the central line, which is an exponential moving average (EMA) of the closing prices, and two outer lines that are set a certain number of average true ranges (ATR) above and below the central line. The distance of the outer lines from the central line gives traders insight into market volatility.

How Does the Keltner Channel Work?

At its core, the Keltner Channel Indicator works by adjusting its bands based on market volatility. The outer bands expand during periods of high volatility and contract during low volatility. This elasticity allows traders to identify potential breakout points. When the price touches the upper band, it may indicate that the asset is overbought; conversely, when it touches the lower band, it may suggest that it is oversold.

Setting Up the Keltner Channel on Pocket Option

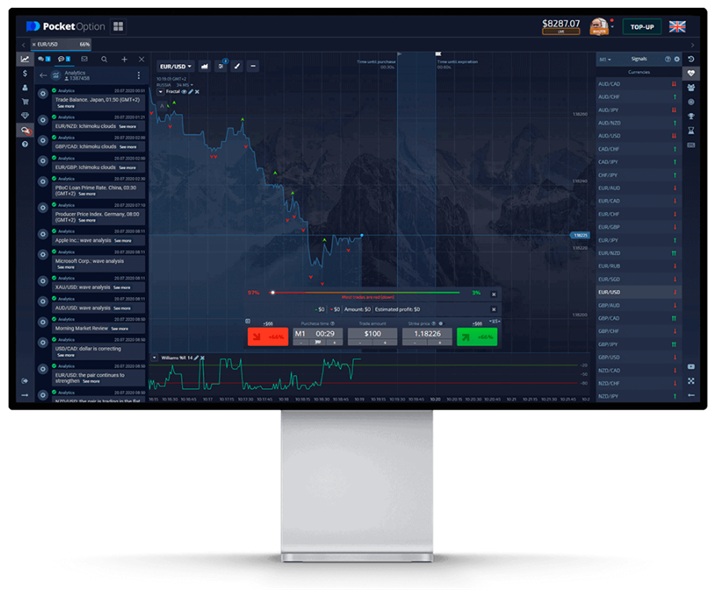

To set up the Keltner Channel on the Pocket Option platform, follow these steps:

- Open your Pocket Option trading account.

- Navigate to the chart where you intend to apply the indicator.

- Click on the ‘Indicators’ tab located on the chart menu.

- Select ‘Keltner Channel’ from the list of available indicators.

- Adjust the settings according to your trading strategy; typically, the default settings work well for most traders.

Interpreting the Keltner Channel Indicator

Interpretation of the Keltner Channel can be straightforward. Here are a few key points to consider:

- Price above the upper band: This often signals an overbought market, where traders might look for potential selling opportunities.

- Price below the lower band: This typically indicates an oversold market, suggesting that it may be a good time to buy.

- Price movement within the channels: Prices bouncing between the upper and lower bands can reflect a ranging market, which can be ideal for short-term trades.

Strategies for Trading with the Keltner Channel Indicator

Implementing trading strategies with the Keltner Channel can vastly improve your trading performance. Here are a couple of effective strategies:

Trend Following Strategy

In a trending market, traders can enter positions when the price bounces off the Keltner Channel bands. For instance, in an uptrend, traders might look to buy when the price retraces to the middle line or the lower band, indicating a continuation of the bullish trend.

Breakout Strategy

When the price breaks above the upper band or below the lower band, it often signifies the beginning of a new trend. Traders can enter trades following the breakout direction, ensuring they set appropriate stop-loss levels to manage risk effectively.

Combining Keltner Channel with Other Indicators

To enhance the effectiveness of the Keltner Channel Indicator, it can be beneficial to use it in conjunction with other technical indicators. For example:

- Relative Strength Index (RSI): Using the Keltner Channel with RSI can provide insight into whether the market is truly overbought or oversold, allowing for more confident decisions.

- Moving Averages: Combining Keltner Channel with different periods of moving averages can provide additional confirmation of entry and exit points.

Risk Management with Keltner Channel

Effective risk management is crucial for sustained trading success. When using the Keltner Channel, it is essential to:

- Set stop-loss orders just outside the Keltner Channel bands to protect against unexpected market movements.

- Use proper position sizing to ensure that no single trade significantly impacts your trading capital.

Conclusion

The Keltner Channel Indicator is a valuable tool for traders seeking to enhance their strategies on the Pocket Option platform. By understanding its functionality, how to set it up, and interpreting its signals, traders can effectively identify market trends and potential trade opportunities. As with all trading strategies, combining the Keltner Channel with sound risk management and other indicators can lead to more informed trading decisions and improved outcomes. Begin experimenting with the Keltner Channel today to elevate your trading experience on Pocket Option!

Leave a reply