Forex trading options offer traders a versatile landscape for engaging in currency markets. With the rise of digital trading environments, a wealth of opportunities has emerged for both novice and seasoned investors. Whether you are looking to hedge risks or speculate on currency movements, understanding the various trading options is the key to success in forex trading. For those interested in regional perspectives, forex trading options Trading Brokers in Qatar can provide localized insights and specialized services.

Understanding Forex Trading Options

Forex trading involves buying and selling currency pairs in a decentralized global marketplace. It is one of the most liquid markets in the world, with trillions of dollars exchanged daily. To navigate this massive ecosystem, traders have several options at their disposal. This article delves into the key forex trading options, highlighting their features, advantages, and risks.

1. Spot Forex Trading

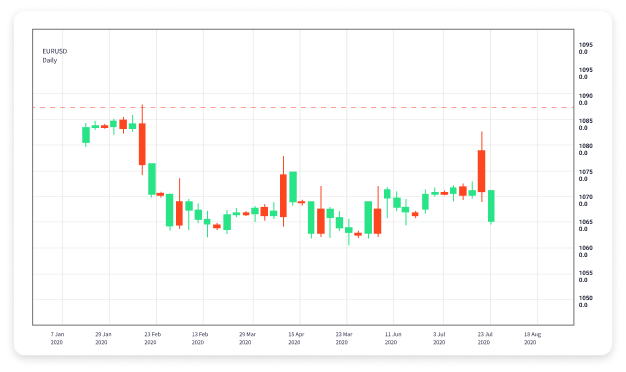

Spot trading is the most straightforward method in forex trading. A trader buys or sells a currency pair at the current market price, with settlement occurring ‘on the spot’ or immediately. For example, if a trader believes that the euro will strengthen against the US dollar, they would buy the EUR/USD pair at the current exchange rate.

Advantages of Spot Trading

- Immediate settlement.

- High liquidity due to continuous market access.

- No expiration date, allowing for flexibility.

Risks of Spot Trading

- Market volatility can lead to significant losses.

- Leverage can magnify both profits and losses.

- Economic events can drastically affect market movements.

2. Forex Futures

Futures contracts are agreements to buy or sell a specific amount of a currency at a predetermined price at a future date. Futures are standardized and traded on exchanges, providing transparency and liquidity.

Advantages of Futures Trading

- Hedging against currency fluctuations.

- Transparent pricing due to exchange-based trading.

- Ability to trade on margin.

Risks of Futures Trading

- Potential for significant losses if the market moves against the position.

- Complexity in understanding expiration and rollover mechanics.

- Less flexibility compared to spot trading.

3. Forex Options

Options provide traders with the right, but not the obligation, to buy or sell a currency pair at a specified price before a certain date. This financial instrument allows traders to speculate on price movements while managing risk.

Advantages of Options Trading

- Flexibility in executing trades based on market conditions.

- Limited risk as the maximum loss is the premium paid.

- Leverage can lead to higher returns.

Risks of Options Trading

- Options can expire worthless, leading to a total loss of the premium.

- Complex strategies can be difficult to understand.

- Liquidity can vary significantly based on the specific options contract.

4. Forex ETFs

Exchange-Traded Funds (ETFs) allow investors to buy a basket of currencies, providing diversification. They are traded throughout the day on stock exchanges, similar to stocks.

Advantages of ETFs

- Diversification reduces risk across multiple currencies.

- Liquidity allows for easy buying and selling.

- No need for an exchange account, reducing entry barriers.

Risks of ETFs

- Management fees can affect long-term profitability.

- Market prices can deviate from the net asset value.

- Dependence on the performance of underlying assets.

5. CFDs (Contracts for Difference)

CFDs allow traders to speculate on the price movements of currency pairs without owning the underlying assets. This derivative product enables traders to access leverage and trade on margin.

Advantages of CFDs

- Ability to short-sell easily.

- High leverage potential amplifies potential gains.

- Flexible trading hours and quick execution.

Risks of CFDs

- High leverage can lead to substantial losses.

- Risk of negative balance during volatile market conditions.

- Counterparty risk due to reliance on the broker.

Choosing the Right Trading Option

When exploring forex trading options, it is crucial to align your choice with your risk tolerance, investment strategy, and market understanding. Each option has its specific set of advantages and disadvantages that cater to different trading styles. Moreover, consider factors such as the liquidity of the options, the fees involved, and the accessibility of trading platforms.

Conclusion

Forex trading provides a plethora of options to cater to diverse trading strategies and investor preferences. By understanding the characteristics, benefits, and risks associated with each trading option—spot trading, futures, options, ETFs, and CFDs—traders can make informed decisions and optimize their trading experience. Continuous education and staying updated on market trends are paramount for success in the dynamic forex landscape. Whether you are a beginner or a seasoned trader, adapting your strategies to the evolving market conditions is essential for achieving your trading goals.

Leave a reply